Big Model 2024: Pursuing Liquidation and Accelerating Shuffle

Author | Cao Shuangtao

Editor | Yang Bocheng

Title map | IC Photo

According to relevant media reports, Baichuan Intelligent, founded by Wang Xiaochuan, the former CEO of sogou Company, is carrying out a new round of financing with hundreds of millions of dollars, which may become one of the largest financing in the domestic AI field in 2024.

Although Baichuan Intelligent did not respond to this financing rumor, some investors revealed that the financing has not yet been finalized, and the specific valuation is different from the market rumor of $1.8 billion.

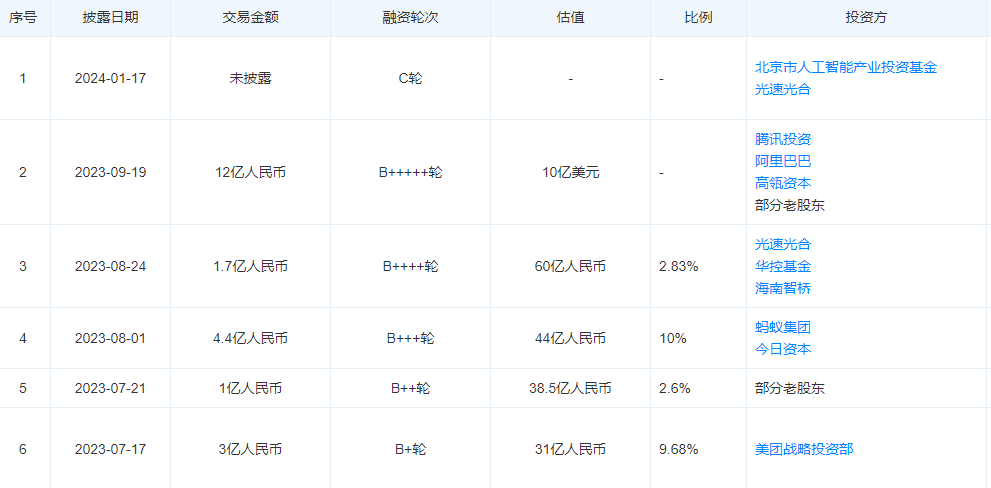

In addition to the valuation of Baichuan Intelligent exceeding 10 billion yuan, the current valuation of the dark side of the moon and MiniMax exceeds 2.3 billion US dollars and 2.5 billion US dollars respectively, and the valuation of Zhipu AI exceeds 10 billion yuan. With the help of capital, these four AI startups are becoming the "four new AI dragons" in the era of generative AI. Take Zhipu AI as an example. In the third quarter of 2023, Zhipu AI directly completed the B5 round of financing.

Source: Tianyancha

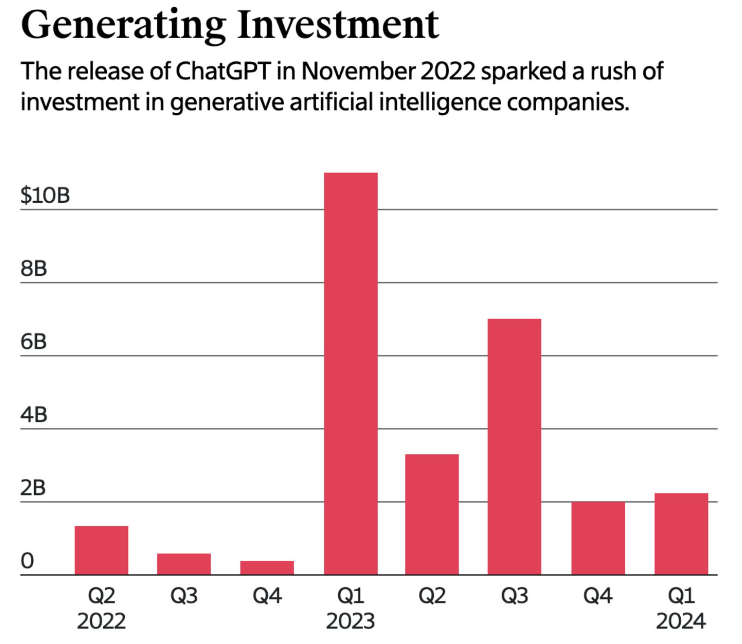

Behind the capital bet on the "new AI Four Little Dragons", or the epitome of the high enthusiasm of the global capital market for the AI big model in 2023.

According to public data, in 2023, the number of investment and financing in AI field in China was about 232, and the total amount of financing was about $2 billion. According to CBInsights data, in 2023, generative AI startups received about $20.4 billion in global financing, more than five times that of $3.6 billion in 2022.

In 2024, the capital market is gradually changing from hot to cold for the big AI model. In the primary market, IT orange data shows that in 2024, the amount of financing for AI production and AI industry applications in Q1 was 12.389 billion yuan and 7.401 billion yuan respectively, and the corresponding number of investment events was 36 and 65 respectively.

If we consider that the "New AI Four Little Dragons" have won a large amount of financing in the industry, other AI start-ups are facing the problem of financing difficulties and less financing, and AI applications have also become a new direction of capital concern.

Overseas markets are similar to those in China. Meritech Capital, which invested in Facebook and Salesforc, as well as TCV, General Atlantic, Blackstone and other institutions have suspended their attention to generative AI. Gartner analyst John-David Lovelock said that the investment of billions of dollars in big models has slowed down and almost ended, and hot money has flocked to AI applications.

Source: The Information Database

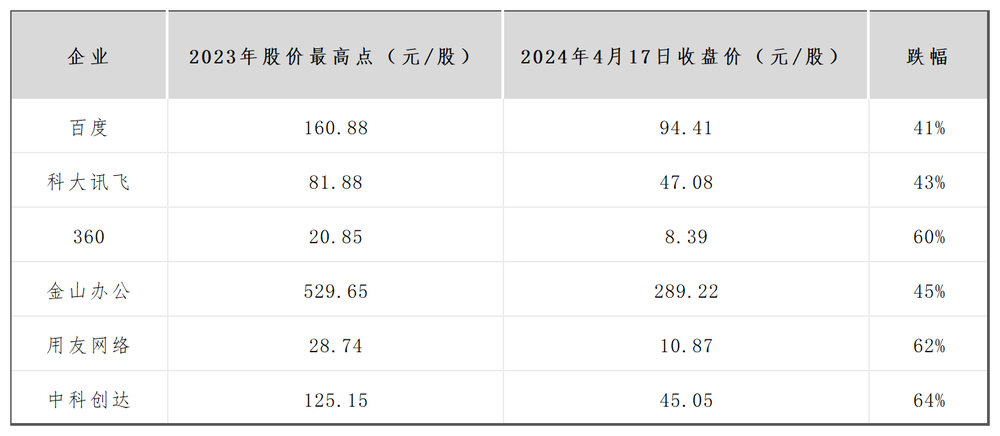

In the secondary market, the AI big model has been difficult to drive the stock price of enterprises to rise. On April 17th, for example, the share prices of Baidu, 360, Iflytek, Jinshan Office and many other enterprises all dropped significantly compared with the highest point in 2023, and some enterprises even fell by over 60%.

Source: Based on public information collation

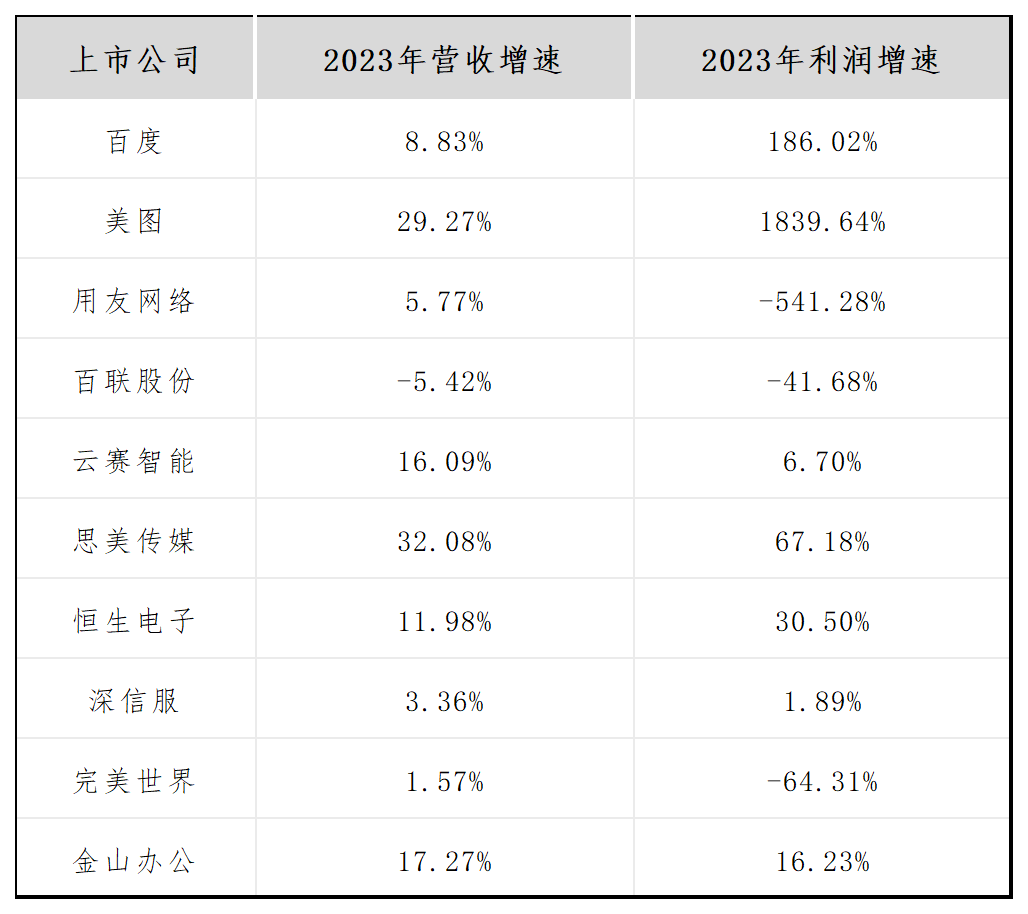

Behind this is that the big model has driven the company’s performance lower than market expectations. Based on the financial reports of many listed companies in 2023, AI has made limited contributions to the performance of other listed companies, except for Baidu and Meitu, which achieved substantial profit growth through AI. In 2023, the net profit of Bailian shares and Perfect World dropped sharply.

Source: Financial reports of major companies

The essence of the primary and secondary markets reveals that with the rapid progress of AI big model technology, how can enterprises hedge the high training cost and research and development cost of big models? How can AI make money, so as to drive the continuous growth of the performance of AI start-ups and quickly complete the IPO to achieve listing?

When commercialization becomes the new direction of AI big model competition in 2024, AI start-ups with doubtful business models and weak revenue growth will accelerate their liquidation, and the industry will usher in a real reshuffle stage.

First, the subscription mode and intelligent hardware at the TOC end need to be accumulated for several years.

Since the development of the big model in 2023, one of the big models on the TOC side has been commercialized as the Internet subscription model. For example, the price of continuous monthly subscription and annual membership in ERNIE Bot is 49.9 yuan and 588.8 yuan respectively. Zhipu AI charges according to tokens used by users during their visit to official website.

Source: official website, ERNIE Bot

The other is to build AI capability and put it on intelligent hardware. In addition to common AI mobile phones, AI learning machines, AI PC, and AI TVs, Humane, an American startup AI company, has also launched an AI Pin with the size of a badge and no screen. The device is connected to the mobile phone software service in Cosm OS mode, and the information is projected on the user’s palm, and the interaction is carried out in voice control mode.

Source: Amazon

However, from the perspective of AI intelligent hardware, whether it is Huawei Mate60, which sold well last year, or Samsung Galaxy S24, which went global, it won 6.53 million units by the end of February this year, all of which are the flagship models of manufacturers. And the profit earned by millions or tens of millions of shipments is almost negligible before the manufacturer’s high R&D investment.

At the same time, changes in overseas consumer markets are forcing manufacturers to decentralize the prices of intelligent hardware products equipped with AI functions.

According to sources in the supply chain, inflation in many overseas countries is still at a high level, and Samsung and Apple have lowered their shipment expectations in 2024. Relevant research institutions have also lowered the growth rate of smartphones from the original 5%-10% to around 5% or lower in 2024. Based on this, mobile phone SoC and brand manufacturers have accelerated the decentralization of AI functions to low-end models in overseas markets, hoping to improve the penetration rate of AI phones.

The same situation also appears in the AI PC market. At this stage, consumers may increase their willingness to buy because of the AI function carried by PCs, but they will not pay higher prices. AI has no obvious value-added effect on PC manufacturers for the time being. If PC manufacturers want to hedge R&D costs, they can only decentralize the price of AI PC.

If the price decentralization drives the growth of shipments and usage, manufacturers must invest more large-scale model computing power to ensure the user experience, which in turn raises the operating costs of manufacturers. Moreover, with the prolonged period for consumers to buy smart hardware such as smart phones and PCs, hardware products such as computing chips and peripheral chips also need to be prepared 3-5 years in advance to ensure that the upgraded services are not micro-upgraded.

Intelligent hardware manufacturers also need to continue to differentiate AI scene services. Otherwise, under the condition that e-commerce platforms can buy large model members of Internet vendors at low prices, high-priced AI hardware products will make consumers feel that the price ratio is insufficient and discourage consumers.

At a deeper level, AI intelligent hardware products are upgraded or innovated on the basis of existing products, and the consumption logic of intelligent hardware market has not changed. This means that large-scale profit can be achieved by driving sales growth through AI equipment, and the time period may be longer.

Considering that the global intelligent hardware market segment is basically mastered by the head manufacturers, and most of these enterprises are mainly self-developed AI models, leaving limited opportunities for AI startups.

Domestic AI start-ups that are aware of this problem are mostly based on Internet subscription, and the scenes are mostly concentrated in the fields of chat bots and derived AI virtual companionship. For example, Star Field of MiniMax has grasped the market demand with domestic female game users as the core, and brought value-added charging points for products on the basis of chat and dialogue.

If you want to run through the Internet subscription mode, the core needs to solve key problems such as user growth, user experience and user retention. Especially when the domestic TOC users are not aware of the payment, it is necessary to ensure the continuous growth of the big model APP DAU.

In terms of user growth, based on the advantages of traffic, brand and user accumulation, the growth rate and cost of obtaining users will be lower than that of AI start-ups. However, if we refer to the development of ChatGPT, Miaoya camera and kimi, if AI start-ups can create a large explosion model, it can save a lot of promotion costs and achieve exponential growth.

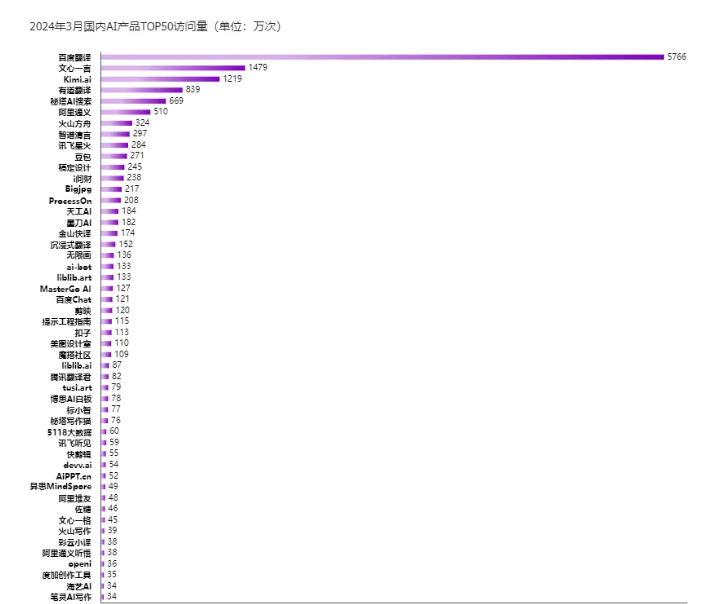

For example, in March this year, the most visited AI products in China were Baidu Translation, Baidu Wenxin and Kimi, with 57.44 million, 14.79 million and 12.19 million visitors respectively. Among them, the number of visits by kimi has tripled compared with the same period of last month.

Source: Similar

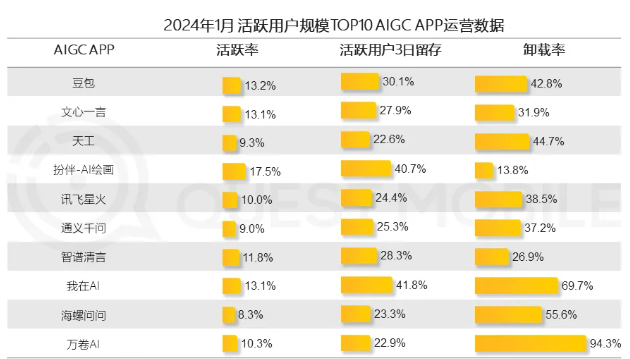

However, at present, the retention of users of large model apps is worrying. Quest mobile data shows that in January 2024, the proportion of active users of TOP10 domestic model apps was less than 20%, the three-day retention rate was less than 50%, and the unloading rate of 10,000 volumes of AI reached 94.3%.

Under the 100-mode war in 2024, various AI scene APPlications emerge in an endless stream, which makes users more critical. At the same time, it is more difficult for various enterprises to build explosive model apps. The cost of AI startups to gain user growth through information flow, app stores and app stores will continue to rise. How to continuously innovate the scene and ensure the retention of users has become a difficult problem for AI startups.

Source: Quest mobile

The instability of user retention will directly affect the operating costs of AI enterprises. For example, when the number of user visits increases sharply, AI enterprises need to expand the computing power of large models. However, when the number of visits plummeted, the problem of idle computing power of large models appeared again.

Considering the current high cost of large-scale model computing power, how to share the cost to reduce the computational burden and how to "cut the peak and fill the valley" of large-scale model computing power is another difficult problem faced by AI company.

Second, TOB end: AI big model is developing along the path of SaaS.

Different from the commercialization of TOC-end big model, which needs long-term accumulation of users to get through the profit mode, the commercialization of TOB-end big model may achieve faster results. All kinds of software, such as AI big model, SaaS and cloud, are valuable only if they bring real cost reduction and efficiency improvement to enterprises, and only then will business owners be willing to pay the bill.

At present, the value of cost reduction and efficiency improvement brought by AI big model to enterprises is being reflected. After the Sore explosion at the beginning of this year, many Hollywood companies in the United States started to lay off employees.

According to a report released by Adecco Group, a human resources provider, due to the rapid progress of AI big model technology, after investigating the senior executives of 2,000 large companies around the world, it was found that about 41% of senior managers expected that the number of employees would decrease. Overseas giants such as Google and Microsoft have started a wave of layoffs since the beginning of this year.

However, the willingness of domestic business owners to buy software is low, which can be seen from the difference in software GDP between China and the United States and the valuation of domestic SaaS vendors generally lower than that of the United States. More importantly, at present, the value brought by the TOB-end big model to enterprises is still in a fragmented state.

Source: wind

According to the love analysis report, in 2023, the domestic large model market scale was only 5 billion yuan, and in 2024, it only increased to 12 billion yuan. Although Kingdee and UFIDA released large-scale model products one after another in 2023, they also held a large number of TOB-side enterprise resources. However, the financial reports of the two companies in 2023 were not good-looking. Although Kingdee’s net profit growth rate turned from negative to positive, its revenue growth rate almost stagnated, and UFIDA’s net profit growth rate plummeted by more than 500%.

Source: Enterprise Alert

How to make domestic TOB-side business owners truly realize the value of the big model, especially compared with traditional SaaS services. It has become a problem that AI enterprises urgently need to solve in order to develop the TOB-end big model market.

Further, the commercial customization service of TOB-side large model will face two thorny problems in the future.

On the one hand, price power is the key for SaaS enterprises and cloud enterprises to remain competitive. In February this year, after Alibaba Cloud started to reduce prices in the domestic market, the prices of many products supporting offshore data centers continued to decrease in April, with some products dropping by as much as 59%.

On the other hand, the price war of new energy vehicles from 2023 to now has completely entered a white-hot stage. And the OEM also realized that the price war will not stop in the short term, and they are looking for upstream autopilot manufacturers to make profits.

As a strong party, OEM has absolute right to speak. Autopilot solution manufacturers increase brand awareness based on winning more orders from OEMs, and OEMs generally require enterprises to have complete project experience in the bidding stage, so they can only reduce prices continuously.

With the increasing number of AI companies currently deploying the TOB-side commercialization model, it is difficult to guarantee that the story that happened to the autopilot solution provider will not appear in AI companies in the future. Price wars among peers and downstream customers demand price cuts. Will AI companies increase their income but not increase their profits like autonomous driving companies in the future?

On the other hand, customizing a large model for the TOB side is not only a cliche about data security, deployment cost, specialization, and a high understanding of customer needs. AI enterprises also face similar problems with SaaS enterprises and cloud service enterprises. For example, customized services have low reproducibility and repeatability, high enterprise investment, and long customer tracking time. In particular, the payment cycle of large enterprises is relatively long, and the cash flow requirements for AI start-ups are extremely high.

Third, the AI new creation knockout started, and the industry ushered in accelerated integration

At present, in overseas markets, the AI new creation knockout tournament has started, and some AI start-ups with wrong business strategies are being harvested by big factories. For example, companies such as Banana, Togo, and RunPod in the United States provide GPU server rental services to AI startups that cannot afford cloud services from large manufacturers at low prices. In 2023, when AI was hot and GPU was out of stock, these companies also won a lot of financing.

However, when AI Xinchuang gets a lot of financing, it will buy services from GPU server manufacturers instead of looking for "Banana" lease. And compared with the large model with a wide range of applications, many enterprises hope to adopt a small model that is more correct in the professional field and lower in cost. This has caused a serious decline in the demand of "Banana", and Banana also announced the termination of the service in March this year.

According to Bloomberg News, in March this year, Microsoft acquired Mustafa Suleyman, founder of Influence AI, and 70 employees, and invested $650 million to obtain AI software authorization.

GavinBaker, a senior executive of Atreides Management, an investment institution, said that the basic model will become the fastest depreciated asset in history if proprietary and real-time data cannot be obtained and there is not enough deployment pipeline.

Bloomberg columnist Olson said that although these AI startups supported by venture capital have technical capabilities, it is not easy to build computing power enough to support text and image-generated AI, which will cost tens of millions of dollars. In the future, AI start-ups such as Anthropic, Character Ai and Perplexity will encounter similar problems as Inflection AI, that is, they cannot find a feasible business model.

Large-scale technology companies such as Google, Amazon, Meta, etc. are continuing to wait and see for start-up AI companies, and will acquire a large number of talents and technologies from these AI start-ups without touching on antitrust.

This scene that is being staged in overseas markets will also be accelerated in the domestic market in the future. On the one hand, the commercialization of domestic large models is different from that of Europe and America. If you want to drive the performance growth of AI startups by going out to sea, you need to face strict regulatory supervision and data compliance challenges.

The report "The AI Index Report 2024" issued by the AI Research Institute of Stanford University pointed out that the US AI regulatory regulations have increased significantly in the past five years, especially in 2023, there were 25 sets of AI-related regulations, compared with only one set in 2016.

Overseas technology companies such as Microsoft, Google and OpenAI have been robbing the world’s top AI talents through higher R&D investment. For example, Demis Hassabis, CEO of Deep Mind, Google’s AI department, predicts that the company’s spending on artificial intelligence technology may exceed $100 billion.

On the other hand, the pursuit of maximizing the return on investment is the goal of constant capital, but the IPO of AI startups in the global market is not smooth at present. For example, Reddit in the United States said in the IPO that AI will become a new growth area for the company.

However, according to the report of JPMorgan Chase, by Q4 of 2023, the basic users of Reddit were 73 million. Even if DAU can increase to 109 million in 2026, there are still big differences compared with social apps such as Meta, Facebook and X. Based on this, Goldman Sachs and JPMorgan Chase gave a "neutral" rating and a target price of $40 and $47 respectively.

Source: Reuters

If domestic AI start-ups fail to meet capital expectations in terms of user and revenue growth. In the current cold winter of the capital market, how much patience does capital have? How do AI start-ups that can’t get a new round of financing face the rising prices in the upstream of AI? Samsung, TSMC, Qualcomm, Micron and other AI upstream enterprises, the Q1 revenue and profit growth rate in 2024 exceeded expectations.

Undoubtedly, the future AI big model will definitely produce greater economic value. Only when the commercialization of the domestic AI model is still unclear, how many companies will fall in the night before dawn?